Without the ag/timber number, you will be forced to pay tax to the retailer upon your purchases. If you decide to fill out the application and mail it in, it can take three to four weeks for processing time. Note: If you file through eSytems/Webfile it takes 10 minutes and your ag/timber number will be issued at the end of the process. It is recommended that you create an eSystems/Webfile account to register for an ag/timber number click here to register online or here for a paper application. Your SOS file number if you are registered with the Texas Secretary of State (SOS).Your social security number or your identification number and country of origin.Necessary details about your business such as an address, primary products, and services.To apply for the exemption certificate, you will need:

#TEXAS AG EXEMPTION NUMBER REGISTRATION#

You are also required to include this number on your registration certificate when making purchases.

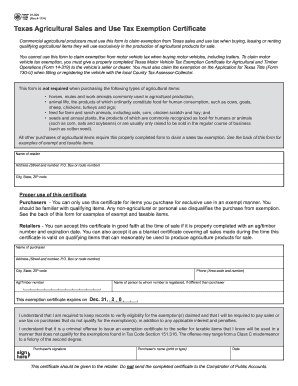

To get the tax exemptions on agricultural items, you must first apply for an ag/timber registration number from the Texas Comptroller.

#TEXAS AG EXEMPTION NUMBER HOW TO#

How to Apply for a Texas Agricultural and Timber Registration Number (Ag/Timber Number)

For items to qualify for the tax exemptions, they must be used exclusively in the production of farm products. It’s not a question of who qualifies but what is eligible for the Texas agricultural sales and uses tax exemptions. Who qualifies for the agriculture exemptions?Īnyone involved in farming, ranching, or timber production can claim sales and use tax exemptions for their agricultural-related purchases. These include seed, animals, feed, chemicals (fertilizers and pesticides), machinery and parts, and repairs. Throughout the States, there are six primary agriculture exemptions that you can qualify for as an agricultural producer. The purchase of a property with the intention of use within a state is subject to levies unless a special tax exemption is available. Once you’ve updated your ag/timber exemption number, please provide us with a copy with the new expiration date.Sales & Use Tax Exemptions in Agriculture Keep in mind, you will not receive confirmation for up to six weeks. Be sure to keep a copy of the letter for your records. Mail a complete, signed renewal letter to the comptroller’s office by Novemto ensure it gets there in time. The comptroller’s office will mail a confirmation letter and courtesy card in about a week. Once you’ve completed the process it will take two business days for your ag/timber number to be renewed. This telephone line is available for ag/timber renewals 24-hours per day, seven days a week. You will receive immediate confirmation and can print your courtesy card from the website.Ĭall the comptroller’s office at 1-844-AG RENEW (1-84). Follow the onscreen instructions to complete the ag/timber renewal. Your current ag/timber number (you can look it up here.Those renewing an ag/timber exemption by mail will have the longest wait, as it could take four to six weeks. If you apply by phone, expect to get your confirmation letter by mail in five to seven days. Online renewal is the fastest option, as you will receive your confirmation number immediately. There are three options for renewing your exemption certificate: online, by phone or by mail. Only one certificate is required for members with multiple qualifying meters. So even if you just received your exemption certification in the last year or two, you will have to renew it before January 1. The law requires that ag/timber numbers expire every four years on the same date, regardless of when the number was first issued. Otherwise, SPEC will be required to charge sales tax beginning in January. If you claim a sales tax exemption on electricity used in the production of agricultural or timber products, you must renew your exemption by Decemthrough the Office of the Texas Comptroller of Public Accounts.

0 kommentar(er)

0 kommentar(er)